Getting The Fix And Flip To Work

Table of ContentsThe Main Principles Of Fix And Flip Fix And Flip Can Be Fun For EveryoneHard Money Loans Can Be Fun For AnyoneWhat Does Lenders Near Me Mean?Hard Money Lenders Oregon Things To Know Before You Buy

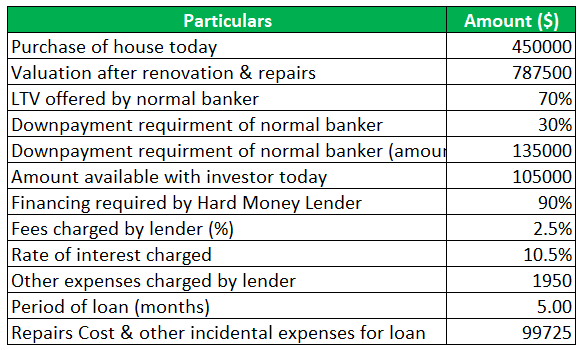

Difficult cash resembles a swing loan, which usually has similar criteria for lending as well as expenses to the consumers. The main difference is that a bridge loan frequently refers to a industrial property or investment home that may be in shift as well as does not yet certify for traditional financing, whereas tough money usually refers to not just an asset-based loan with a high rates of interest, yet perhaps a troubled economic circumstance, such as financial obligations on the existing home mortgage, or where bankruptcy and foreclosure proceedings are occurring. This is recognized as the funding to value (LTV). These fundings are implied for capitalists as well as the loan providers will certainly constantly require a greater down repayment.

The Of Commercial Loans

Due to the fact that the main basis for making a hard money lending is the liquidation value of the collateral backing the note, hard money loan providers will constantly want to establish the LTV (finance to worth) prior to making any extension of financing. A difficult cash lender identifies the value of the property via a BPO (broker price opinion) or an independent appraisal done by a licensed evaluator in the state in which the home is located.

Hard cash lendings are considered finances of "last resort" or temporary bridge finances. Difficult cash lendings are mostly utilized for real estate deals as well as are cash from a private or firm and also not a financial institution.

Since difficult cash fundings depend on security rather than the monetary setting of the applicant, the financing time structure is shorter. Terms of tough money fundings can frequently be worked out between the lender and the borrower.

What Does Hard Money Lenders Oregon Do?

Given that conventional lenders, such as banks, do not make tough money financings, hard cash loan providers are usually personal people or firms that see worth in this sort of potentially high-risk venture. Hard cash finances may be looked for by residential property flippers who intend to remodel and also resell the genuine estate that is made use of as collateral for the financingoften within one year, otherwise earlier.

Difficult money borrowing can be seen as an investment. There are lots of that have actually used this as an organization version as well as Full Article proactively practice it.

Tough money fundings may be used in turn-around situations, temporary financing, as well as by customers with inadequate credit report Considerable equity in their residential or commercial property. Because it can be issued swiftly, a difficult cash loan can be made use of as a means to fend off foreclosure (Private Money Loans). There are advantages and disadvantages to difficult money car loans associated to the authorization process, loan-to-value (LTV) ratios, and also rates of interest.

Hard Money Lenders Fundamentals Explained

The personal investors that back the tough money car loan can choose quicker since the loan provider is concentrated on collateral instead of an applicant's monetary placement. Lenders invest less time brushing with a funding application verifying earnings and also examining monetary records. If the borrower has an existing partnership with the lending institution, the procedure will be even smoother.

Given that the home itself is utilized as the only protection versus default, difficult money car loans typically have reduced LTV proportions than traditional loans: around 50% to 75%, vs. 80% for regular home loans (though it can go higher if the borrower is a skilled flipper). Also, the rate of interest tend official site to be high.

One more drawback is that hard financing lenders may elect to not provide funding for an owner-occupied house as a result of governing oversight as well as compliance rules (Precision Capital).

Hard Money Lenders Oregon for Beginners

Hard cash fundings give cool, difficult cash swiftly usually in just a few days. These loans are safeguarded by a physical asset (like real estate) that the lender can take ownership of if you fail.

You can not borrow 100% of the possession's worth either, but rather only 65% to 75%. The lender wishes to leave some room for profit in situation you fail. Hard cash fundings themselves have high APRs and also finance terms of one to five years. This sort of car loan can be beneficial when you're in between a rock as well as a difficult place.

Know, though, that it's an extra pricey method to obtain the cash you need. Being a sound you make when you're cool, BRRRR stands for "purchase, remodel, lease, re-finance and repeat" it's a phrase as well as technique utilized by home flippers. If you don't intend to wait the 6 linked here weeks or so that it takes to shut on a mortgage refinance, you can utilize a difficult cash financing to help you finish the BRRRR procedure rather.